Does US import duty include shipping cost?

How is import duty calculated in USA

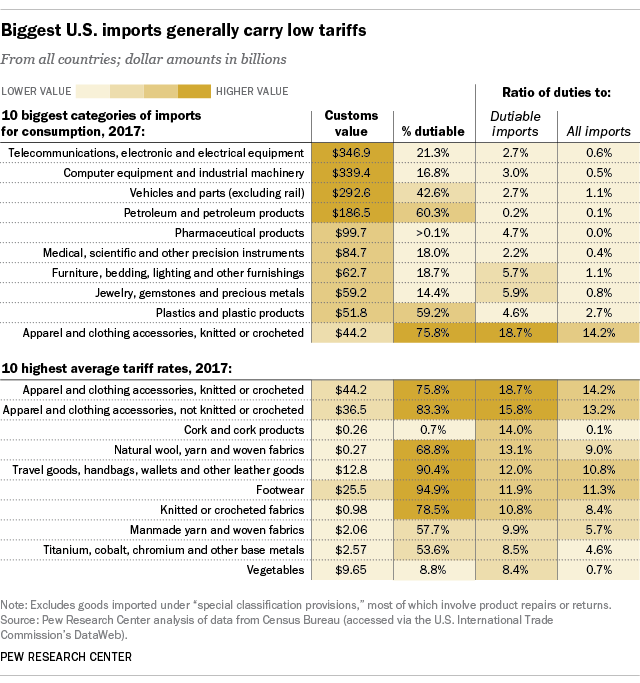

The Customs Duty Rate is a percentage. This percentage is determined by the total purchased value of the article(s) paid at a foreign country and not based on factors such as quality, size, or weight. The Harmonized Tariff System (HTS) provides duty rates for virtually every existing item.

Is duty calculated on shipping

Duty is calculated against the value of the shipment's contents declared on the commercial invoice, together with any insurance costs and a percentage of the transportation cost – this is known as the value for customs.

How much is duty from Japan to us

All products — 4.3%

Is there import tax from Japan to USA

Depending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.

How much can I import to USA without paying duty

In most cases, the personal exemption is $800, but there are some exceptions to this rule, which are explained below. Depending on the countries you have visited, your personal exemption will be $200, $800, or $1,600.

How much is customs duty in USA

Duty rates vary from 0 to 37.5 percent, with a typical duty rate about 5.63 percent. Some goods are not subject to duty (e.g. some electronic products, or original paintings and antiques over 100 years old). The United States has signed Free Trade Agreements (FTAs) with a number of countries.

How is shipping cost calculated

DIM weight is calculated by multiplying the length, width, and height of the package or box size, then dividing by a standard DIM divisor. Shipping carriers like USPS, FedEx, and UPS calculate shipping charges based on whichever is greater: the actual weight of the package or its DIM weight.

How much import tax will I pay USA

Duty tax rates are between 0 to 37.5% with the typical rate being 5.63%. A flat rate of 3% applies to e-commerce purchases that are in excess of the US import tax threshold limits.

What is the duty-free allowance in Japan

One ounce is about 28ml. 200,000yen. Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles. There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.

How can I avoid import duty

Unfortunately, there's no legal way to avoid import duty—if the duty is owed, someone has to pay it. However, there are ways that you can avoid delays when importing goods from abroad and make sure you're not paying import duties that you don't actually owe.

Do you pay duty on items made in the USA

Personal exemptions

In general, the goods you include in your personal exemption must be for your personal or household use. You do not need to pay duty on goods for personal use that are marked as made in Canada, the United States or Mexico.

Do I have to pay import tax from China to us

Customs duties are owed on nearly every product imported from China to the United States. This rule applies so long as the total value of the imported goods totals $800 or more (known as the De Minimis value).

Who pays shipping costs

The receiver is responsible for arranging and paying for the actual shipping cost from the port of origin to the destination port and for arranging and paying for transportation to any further destination. The shipper is, thus, free of responsibility once the goods are on board the ship.

How much does it cost to ship a 50 pound box

| Weight Tiers | FedEx Ground | FedEx Standard Overnight |

|---|---|---|

| 41-45 lbs | $39 | $165 |

| 46-50 lbs | $41 | $176 |

| 51-60 lbs | $43 | $204 |

| 61-70 lbs | $46 | $237 |

How can I avoid US import tax

What methods are used to avoid customs fees Customs duty and tax is based upon the total value of the goods. Declaring a value lower than the true cost of goods value could therefore reduce the customs fees. Some customs authorities have duty and tax reliefs for items sent as gifts.

How much can I spend in the US duty-free

In most cases, the personal exemption is $800, but there are some exceptions to this rule, which are explained below. Depending on the countries you have visited, your personal exemption will be $200, $800, or $1,600.

How much duty-free can I bring to us

Duty-free exemptions

In most cases, travelers are permitted to bring up to $800 worth of merchandise back to the United States without having to pay duty. (Numerous exceptions apply.)

What is shipping fee included

Shipping Fee Included is a service for sellers where a shipping fee is not required for certain products. This means that sellers will not incur any shipping costs, and buyers will not have to pay any shipping fees.

Is shipping cost part of cost of sales

As mentioned above, inbound shipping costs are part of COGS. However, shipping to the consumer is not. It's important to stay on top of these expenses as they affect your bottom line significantly and can eat away at your profit if you don't have a shipping cost reduction strategy in place.

How much does it cost to ship a 100 pound box

| Weight Tiers | FedEx Ground | FedEx 2Day |

|---|---|---|

| 61-70 lbs | $46 | $193 |

| 71-80 lbs | $51 | $231 |

| 81-90 lbs | $54 | $259 |

| 91-100 lbs | $58 | $275 |

0 Comments