How much is import duty for USA?

How much is import customs duty in USA

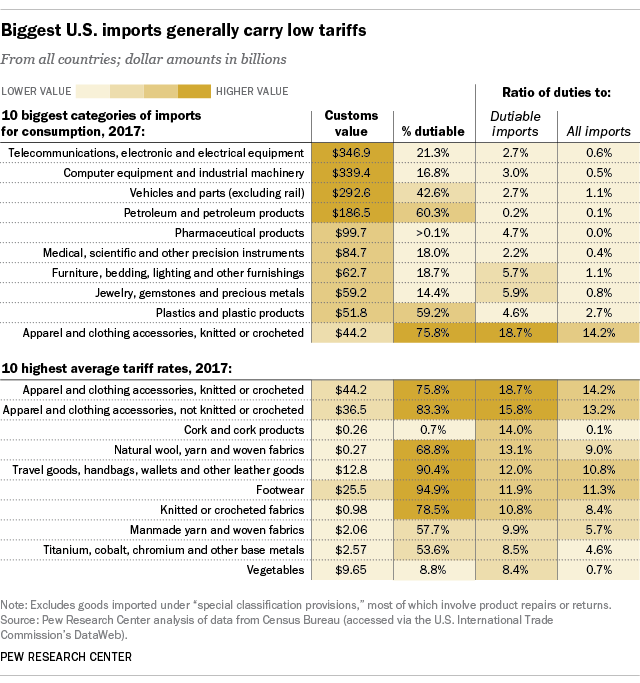

The amount of import tax and duties to be paid depends on the country from which the goods are imported. Duty tax rates are between 0 to 37.5% with the typical rate being 5.63%. A flat rate of 3% applies to e-commerce purchases that are in excess of the US import tax threshold limits.

How much is duty from Japan to us

All products — 4.3%

How much can I import to USA without paying duty

In most cases, the personal exemption is $800, but there are some exceptions to this rule, which are explained below. Depending on the countries you have visited, your personal exemption will be $200, $800, or $1,600.

Is there import tax from Japan to USA

Depending on the type of product you plan to import, you will have to pay a customs duty on goods shipped from Japan if they are for commercial use. Certain goods are duty-free according to the harmonized tariff schedule of the U.S. (HTSUS), whereas other goods do require duty to be paid.

Do you pay duty on items made in the USA

Personal exemptions

In general, the goods you include in your personal exemption must be for your personal or household use. You do not need to pay duty on goods for personal use that are marked as made in Canada, the United States or Mexico.

How do I check my custom duty online

Can you check custom duty papers online Unfortunately, to this day, it is impossible to check custom duty in Nigeria online. Even though a lot of people have been waiting for the introduction of such system that could make everyone's life easier, we are yet to see it being implemented.

How much does an import from Japan cost

What import fees do I have to pay You can expect to pay about 2.5% of the purchase price as the customs duty on a vehicle imported from Japan to the United States.

Does Japan have duty-free

There are many Japanese duty-free shops located in airports and major metropolises, like Tokyo, Osaka, and Kyoto. In addition, most shopping centers, department stores, and major clothing stores have duty-free counters inside. These include but are not limited to retailers like Don Quijote, UNIQLO, and Tokyu Hands.

How can I avoid U.S. import tax

What methods are used to avoid customs fees Customs duty and tax is based upon the total value of the goods. Declaring a value lower than the true cost of goods value could therefore reduce the customs fees. Some customs authorities have duty and tax reliefs for items sent as gifts.

What is the duty-free allowance in Japan

One ounce is about 28ml. 200,000yen. Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles. There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.

How can I avoid US import tax

What methods are used to avoid customs fees Customs duty and tax is based upon the total value of the goods. Declaring a value lower than the true cost of goods value could therefore reduce the customs fees. Some customs authorities have duty and tax reliefs for items sent as gifts.

Can items be shipped from Japan to USA

Due to the considerable distance between the two countries, goods from Japan are shipped to the US by using either airfreight or ocean freight.

Do I pay import duty for personal goods shipment to us

Some products imported into the U.S. are exempt from duties. For example, most personal goods can be brought into the U.S. without paying duty or taxes. Household effects, like furniture, books, certain appliances, etc., can be imported duty-free.

Can I import goods to USA

In most cases, you will not need a license to import goods into the U.S. But for some items, agencies may require a license, permit, or other certification.

What is the customs duty of imports

Custom duty is a kind of an indirect tax that is imposed on both exported and imported goods and services. The tax imposed on the import of goods is known as the import duty. Whereas, the tax imposed on the export of goods is known as the export duty.

What is duty paid value

The value for duty is the base figure on which duty you may owe on your goods is calculated. Even if you do not owe duty, the value for duty of goods must still be established so that any applicable assessment of the goods and services tax, provincial sales tax or harmonized sales tax may be calculated.

How much are import fees from Japan to US for a car

What import fees do I have to pay You can expect to pay about 2.5% of the purchase price as the customs duty on a vehicle imported from Japan to the United States.

How do I pay import tax in USA

If you owe Customs duty, you must pay it before the conclusion of your CBP processing. You may pay it in any of the following ways: U.S. currency only. Personal check in the exact amount, drawn on a U.S. bank, made payable to U.S. Customs and Border Protection.

Do I pay import duty on goods from Japan

Customs Duty & Taxes when ordering from Japan

All prices are tax-free; however, charges, depending on the rate applied in the country of reception, may be applied by customs upon import of the package.

How much is duty-free exemption from Japan

Any item whose overseas market value is under 10,000yen is free of duty and/or tax and is not included in the calculation of the total overseas market value of all articles. There is no duty-free allowance for articles having a market value of more than 200,000yen each or each set.

0 Comments